Project Description

Company: SureSave Travel Insurance

Output: Workshops, creative direction, design, content strategy and testing

My Role: Visual Design Lead at World Nomads

« See more case studies

SureSave – Digital PDS

Problem statement

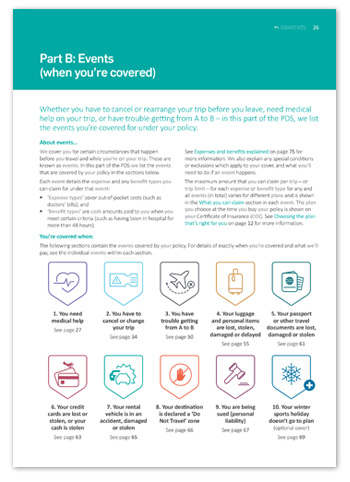

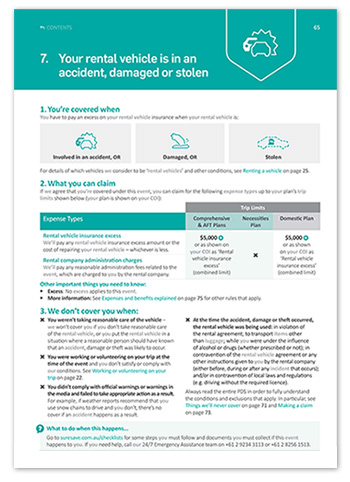

A new Events-based Product Disclosure Statement set to revolutionise the industry and communicate in a way that makes sense to both our agents and our customers. This product is among the first from SureSave to offer a practical explanation of cover in terms of real-life “Events” that customers would actually experience before and while travelling. Replacing the standard list of policy benefits, making policy cover more relatable for travellers. It’s now easier than ever to identify which events your customers may claim under. It uses straight-forward language to make travel insurance easier for travellers to understand and easier for our agents to explain.

The Process

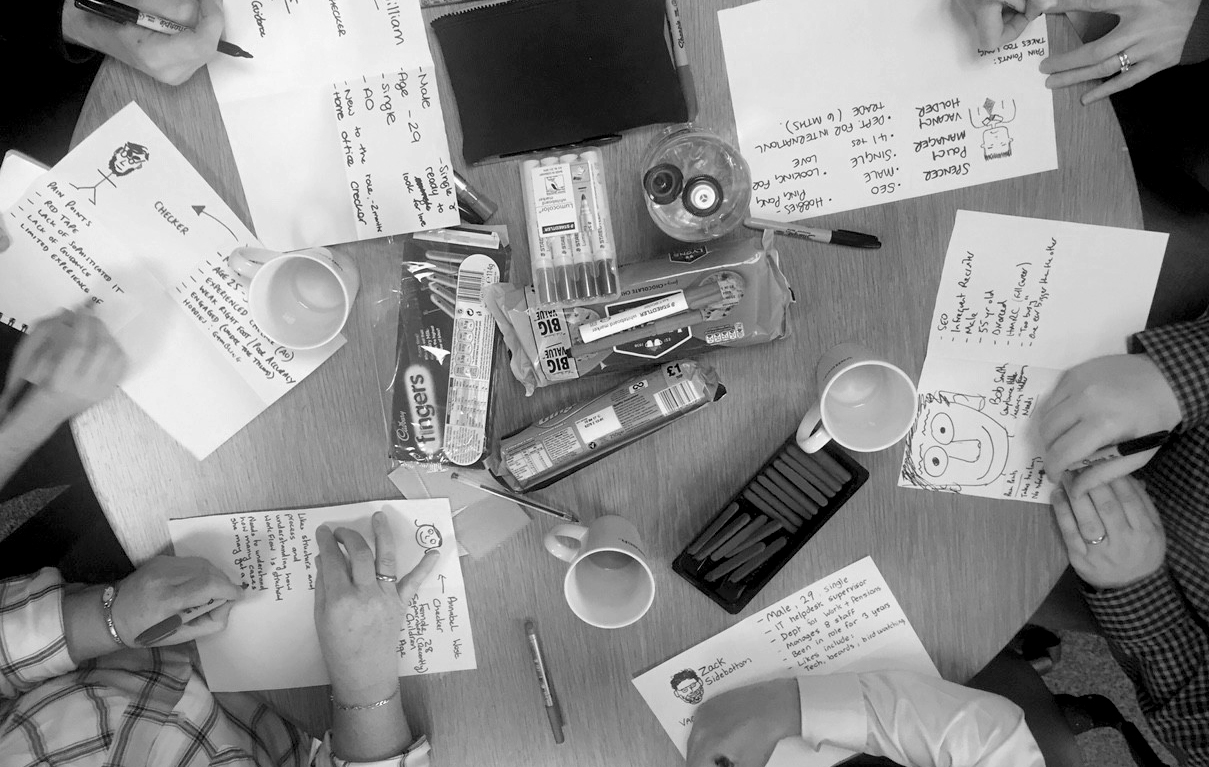

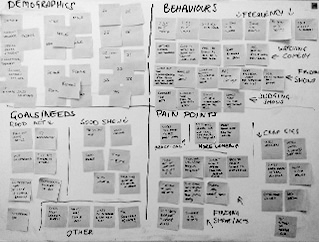

After initial research using stakeholder interviews, speaking with claims officers about their processes & pain points and setting up online surveys for existing customers about their current experience, we discovered the following complex issues and insights into where we could focus our attention. We used the SureSave Travel Insurance Index Questionnaire which gauges insights into the Australian public’s opinions and behaviours regarding travel and insurance. The survey consisted of over 1,000 respondents, findings revealed overwhelmingly, that a significant section of the population has only a ‘general idea’ about what their travel insurance covers them for and need help understanding what and how they can make a claim. As a result, we created typical personas with relating scenarios to test new ways of structuring the policy information to create a PDS that is clearer than ever before.

Findings:

- Only 30 per cent of people know exactly what they’re covered for from their travel insurance policy;

- The majority of people (53 per cent) admit that they only have a ‘general idea’ about what they are covered for;

- Eight per cent are not sure what they’re covered for at all; and

- the majority of claimants had trouble finding if the policy covered their specific scenario or not.

We also held customer interviews where we asked the customer to take us through their entire journey from trip research, booking, travelling, and claiming. One of the key insights was the way customers referred to the moment that caused them to claim or check what they are covered for as an event. e.g. ‘Then I became sick’ or ‘That’s when I lost my bag’. This moment changed our approach and we realised that we needed to structure the entire PDS around events.

After gathering all the data, we began to synthesise these finding into initial experiments to test some ideas of how a new events based PDS might work. Our initial experiment was building an event based question set prototype using formstack. At each step we held multiple user testing sessions which we recorded using Silverback. We then evaluated all feedback and incorporated into the next iteration. In total there were three rounds of testing before we felt confident enough to move into final production.

Outcomes & success metrics

- 23% reduction in call centre inquiries from customers needing assistance with the PDS

- 89% of customers surveyed reported increased ease of understanding & identifying claims

- 2% increase in sales conversion rate

- 9% increase in downloads of the PDS

- Reduced training time for staff with new PDS

- Increased agent & claims officers confidence in explaining coverage

- Fail-safe colour coded pathfinders and iconography for quick visual recognition

- The digital PDF includes hyperlinks for a seamless search

- An overview of benefits and expenses and how they’re calculated when claiming

- Clearer definitions for existing medical conditions, exclusions and waiting periods