Project Description

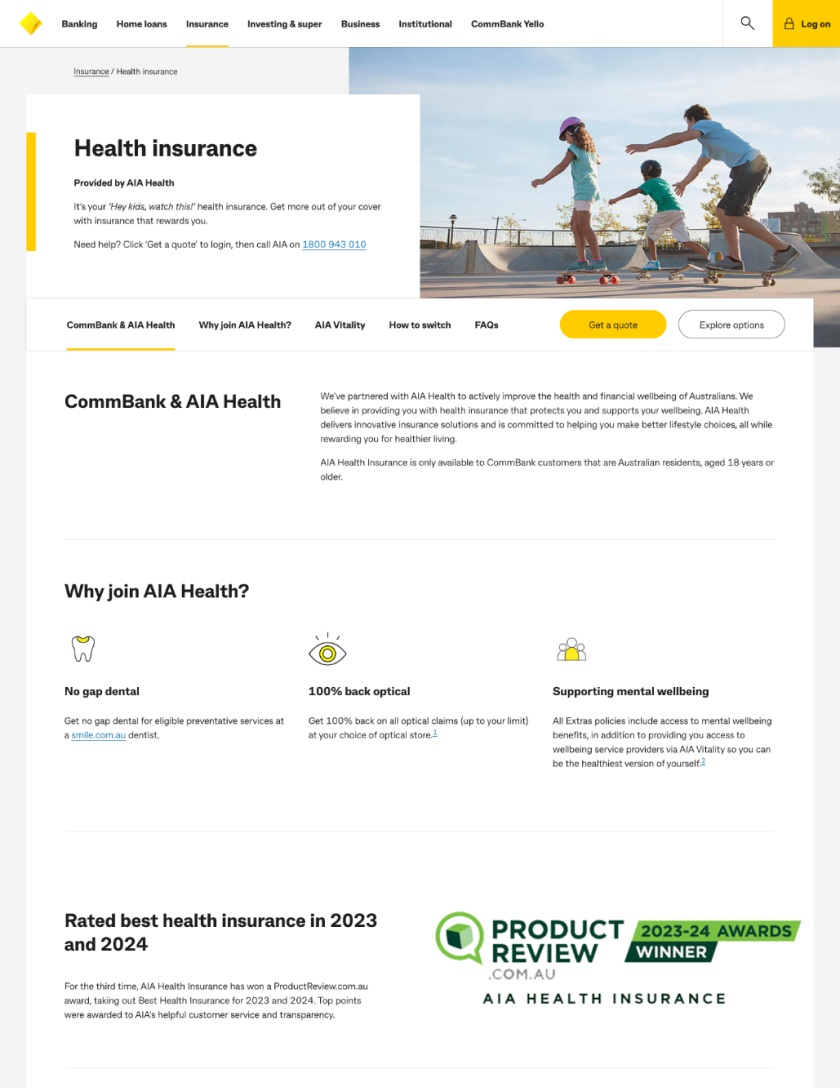

Company:CBA & AIA Health Insurance

Output:Purchase path from CBA to AIA Health insurance

My Role:UX Strategist in a team of four while at Commonwealth Bank, and four from AIA

« See more case studies

CBA – Mobile first website

Problem statement

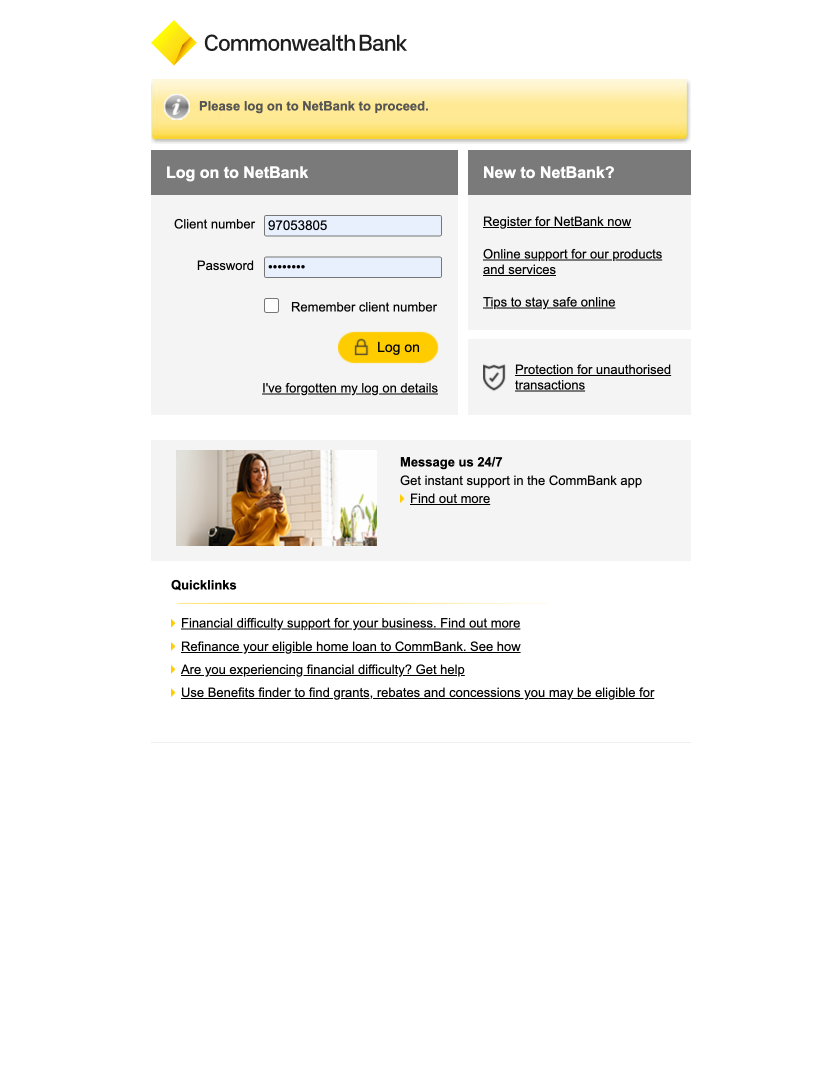

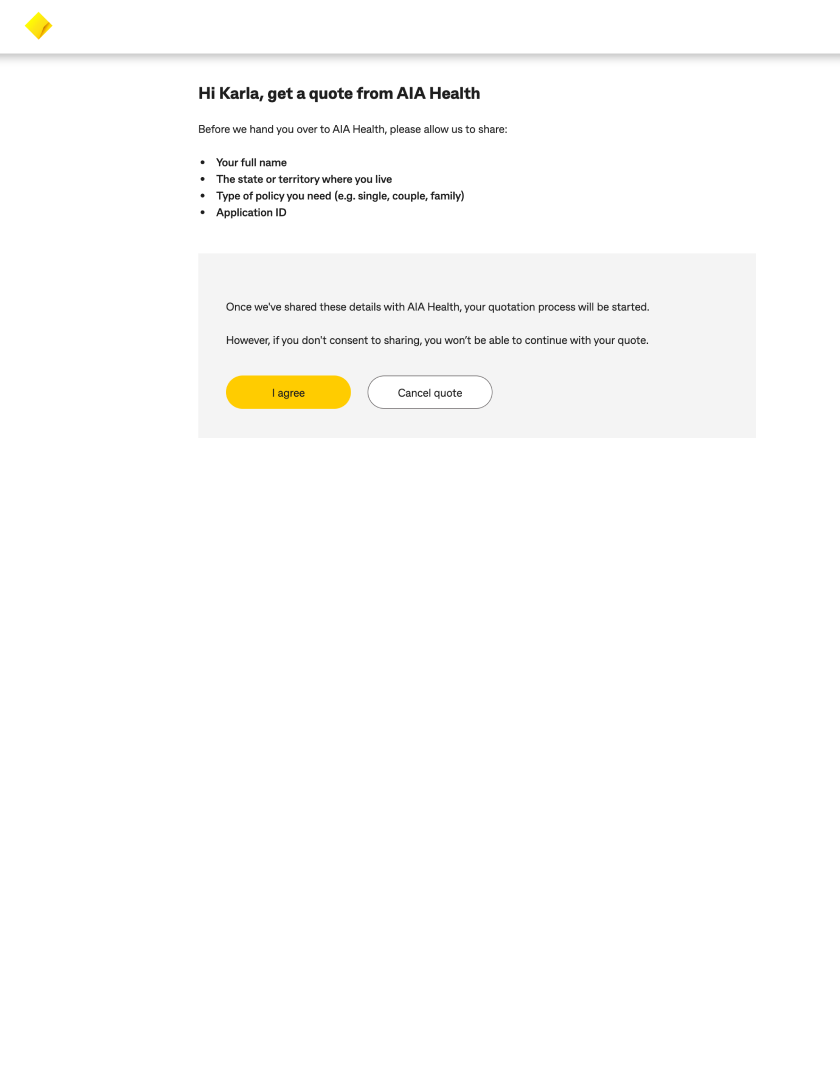

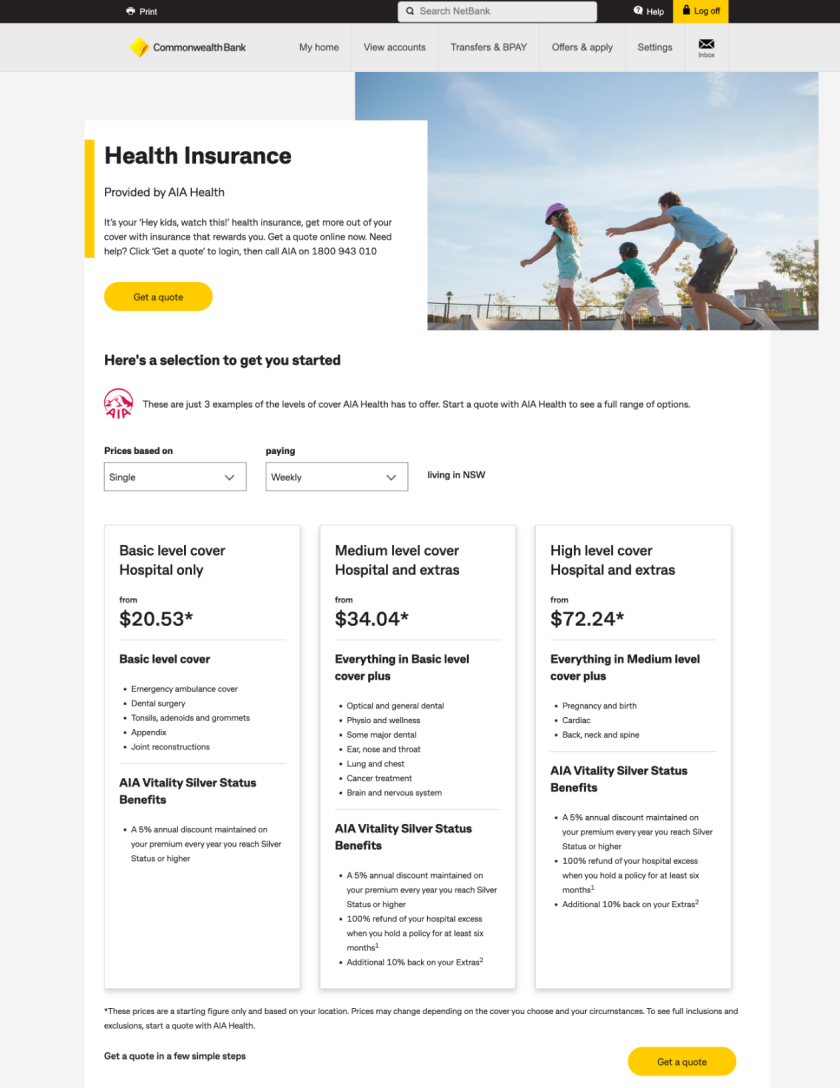

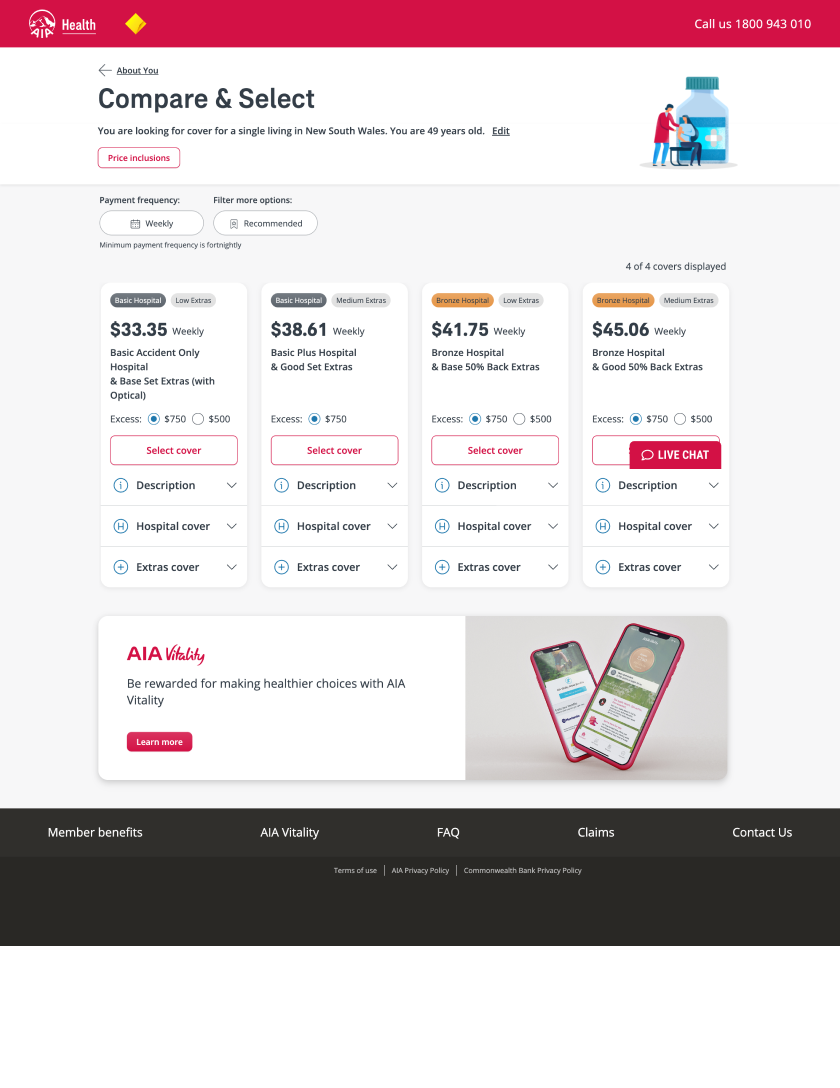

Launch AIA private health insurance product across Comm Bank digital touchpoints. This case study explores the design process for a ground breaking health insurance offering by Comm Bank and AIA Insurance. This first-of-its-market solution allows customers to obtain personalized health insurance quotes with just two clicks, leveraging existing Comm Bank customer data (with consent, of course).

UX Process

- Traditionally, health insurance quotes require extensive form filling, creating a frustrating and time-consuming process. We aimed to revolutionize the experience by offering instant, personalized quotes through a seamless website integration with AIA

- UX design process involved, user interviews, and competitor analysis to identified user pain points and existing market solutions

- Create a recommendation report of industry health insurance companies for AIA

- Collaborate with security and privacy experts to ensure secure and ethical data handling practices

- Guerrilla testing on method and frequency that customers wish to be contacted about health insurance and desirability of product

- Iterative wireframing and prototyping allowed for user testing and feedback throughout the design phase

- Overcoming technical issues of handing over to AIA partner website

- Assure customer privacy of data when transitioning to AIA website with minimum information sharing for maximum impact

- Balancing and promoting AIA Vitality alongside CBA rewards and incentive programs

- Simplify language and give clarity around Australian Government Rebates, waiting periods, age-based discounts, policy excesses and extras

Outcomes and success metrics

CBA and AIA’s collaboration demonstrates the power of user-cantered design and data innovation in financial services. Empowering customers, simplifying complex financial decisions, and strengthens the competitive edge of both institutions. The launch of this innovative solution yielded significant improvements:

- With user consent, CBA securely accessed relevant demographic data from Comm Bank (e.g., age, location) eliminating the need for repetitive data entry, streamlining the quote process significantly

- The website and mobile app featured a user-friendly interface with minimal input fields

- Customers can obtain personalised AIA health insurance quotes in less than 2 minutes<

- User surveys revealed high satisfaction with the speed of the quote process and website’s ease of use

- The streamlined process led to an increase in AIA sales converting from CBA quotes

- Increase in overall traffic to AIA Health and comparing health insurance plans